Gross Domestic Product

- Home

- Statistics

- Economy

- National Accounts

- Gross Domestic Product

Malaysia Economic Performance Fourth Quarter 2021

Malaysia Economic Performance Third Quarter 2021 13 August 2021

Malaysia Economic Performance Second Quarter 2021 11 May 2021

Malaysia Economic Performance 2020 11 May 2021

Malaysia Economic Performance First Quarter 2021 11 February 2021

Malaysia Economic Performance Fourth Quarter 2020 13 November 2020

Malaysia Economic Performance Third Quarter 2020 Show all release archives

Overview

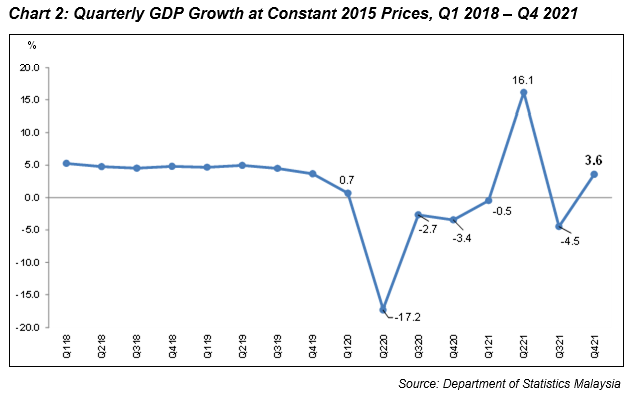

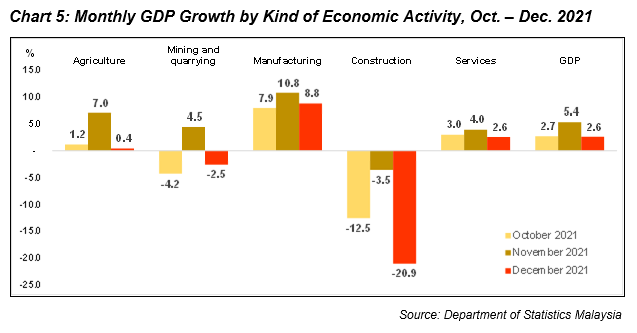

Malaysia’s GDP in the fourth quarter of 2021 rebounded 3.6 per cent in tandem with sturdy growth of Exports and Imports in this quarter. For quarter-on-quarter seasonally adjusted GDP turned around 6.6 per cent (Q3 2021: -3.6%). Correspondingly, the monthly economic performance has grown modestly in the fourth quarter with the growth of 2.7 per cent in October and accelerated to 5.4 per cent in November 2021. Nonetheless, the growth moderated to 2.6 per cent in December 2021. Overall, Malaysia’s economic performance in 2021 showed a recovery momentum with the growth of 3.1 per cent as compared to a decline of 5.6 per cent in 2020.

From the current economic standing, the performance in 2021 is still below its pre-pandemic level in 2019. However, the economic performance for the fourth quarter of 2021 has surpassed the level of fourth quarter of 2019 by 0.01 per cent.

The economic performance in the fourth quarter of 2021 on the supply side was primarily driven by the Manufacturing, Services and Agriculture sectors. On the demand side, all expenditure components experienced positive performance except for Gross fixed capital formation.

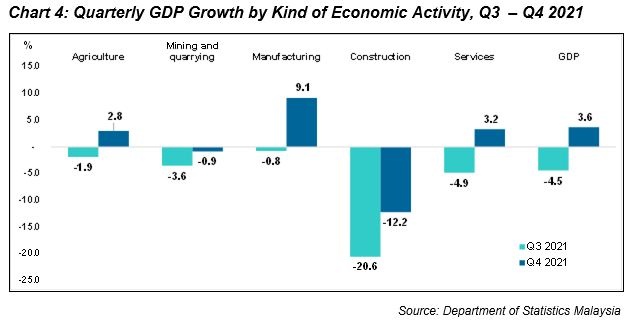

In terms of sectoral performance, Manufacturing sector was the main contributor to the Malaysia’s economic. The Manufacturing sector grew strongly by 9.1 per cent (Q3 2021: -0.8%) in the fourth quarter of 2021 led by Electrical, electronic & optical products (16.4%) followed by Petroleum, chemical, rubber and plastic products (6.5%). The recovery in Non-metallic mineral products, basic metals & fabricated metal products (5.8%) and Wood products, furniture, paper products and printing (5.6%) also influenced the performance of this sector. On a quarter-on-quarter seasonally adjusted, the overall Manufacturing sector increased 8.3 per cent (Q3 2021: -1.8%).

The Services sector rose by 3.2 per cent (Q3 2021: -4.9%) in the fourth quarter of 2021. On a quarter-on-quarter seasonally adjusted, this sector rebounded 7.0 per cent. The performance was attributed to the Private services sub-sector, which recorded an increase of 2.7 per cent (Q3 2021: -6.8%) supported by Information & communication (6.8%), Transportation & storage (11.7%) and Finance & insurance (4.0%) sub-sectors. In addition, Wholesale & retail trade recorded a growth of 1.3 per cent while Real estate, Business services and Private education sub-sectors remained in a declining trend.

The Agriculture sector turned around 2.8 per cent (Q3 2021: -1.9%) in this quarter backed by the rebound in Oil palm (4.8%) and the increase in Other agriculture (5.4%) sub-sectors. The increase of Oil palm sub-sector was in line with the higher production in fresh fruit bunches while the growth of Other agriculture sub-sector was contributed by vegetables, fruits and paddy. Agriculture sector recorded a marginal increase of 0.2 per cent on a seasonally adjusted terms.

The Mining & quarrying sector contracted 0.9 per cent (Q3 2021: -3.6%) influenced by Crude oil & condensate sub-sector which declined 6.5 per cent (Q3 2021: -8.0%) in this quarter. Meanwhile, the Natural gas sub-sector increased 3.9 per cent (Q3 2021: 2.1%). In terms of seasonally adjusted, this sector registered a marginal increase of 0.6 per cent.

The Construction sector recorded a double-digit decline of 12.2 per cent (Q3 2021: -20.6%) in the fourth quarter of 2021. The decline in this sector was mainly influenced by a drop in Residential buildings (-24.3%), Civil engineering (-18.8%) as well as Non-residential buildings (-11.9%). Nonetheless, Specialised construction activities further expanded 9.0 per cent (Q3 2021: 8.9%) in this quarter. On a quarter-on-quarter seasonally adjusted, the overall Construction sector increased 6.2 per cent (Q3 2021: -13.5%).

Private final consumption expenditure which contributed 58.0 per cent to GDP in the fourth quarter of 2021, rebounded 3.7 per cent (Q3 2021: -4.2%) attributed to the higher consumption in Food and non-alcoholic beverages (5.1%), Communication (12.6%) and Housing, water, electricity, gas & other fuels (2.0%). Furthermore, consumption of Restaurants & hotels (3.8%) and Transport (2.0%) grew in this quarter. On a seasonally adjusted quarter-on-quarter terms, the overall performance of Private final consumption expenditure posted an increase of 6.4 per cent.

Gross fixed capital formation (GFCF) or investment on fixed assets decreased by 3.3 per cent (Q3 2021: -10.8%) in this quarter. On a quarter-on-quarter seasonal adjusted performance, the GFCF registered an increase of 10.9 per cent.The smaller decline of GFCF was influenced by the double-digit increase in Machinery & equipment (16.4%). On the contrary, Structure and Other assets registered a decline of 15.5 per cent and 3.1 per cent, respectively. Based on GFCF by sector, both Public and Private sectors recorded a moderate decrease in the fourth quarter 2021.

Government final consumption expenditure moderated 4.3 per cent (Q3 2021: 8.1%) supported by spending on supplies and services attributed to the health-related expenditure in this quarter. The increased in consumption on health services was driven by the Government’s effort in the COVID-19 booster roll-out program. On a quarter-on-quarter seasonally adjusted, Government final consumption expenditure decreased 6.0 per cent (Q3 2021: 5.2%).

Both Exports and Imports accelerated to 13.3 per cent (Q3 2021: 5.1%) and 14.6 per cent (Q3 2021: 11.7%) respectively following the higher trade of goods and services. Therefore, Net exports rose by 2.6 per cent as compared to a decrease of 37.5 per cent in the preceding quarter driven by higher external demand.

The overall economic performance in 2021 was driven by the recovery in the Manufacturing, Services and Mining & quarrying sectors. Meanwhile, the Agriculture and Construction sectors showed a decline in 2021. Overall GDP expenditure was impelled by the components of Private final consumption expenditure and Government final consumption expenditure. On the other hand, Gross fixed capital formation and Net exports were still in the negative growth. In 2021, GDP at current prices amounted to RM1.5 trillion with a Gross National Income per capita increased by 7.7 per cent as compared to 2020.

GDP performance 2021 compared to 2019

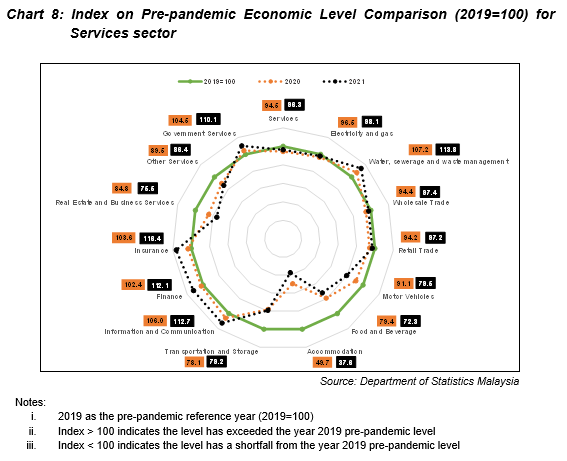

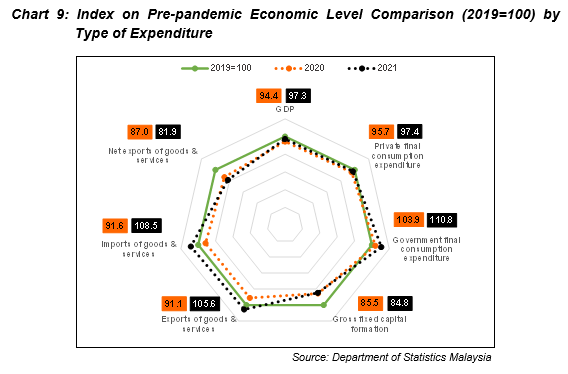

Performance in 2021 was still below its pre-pandemic level of 2019 influenced by all sectors except for Manufacturing sector. Services sector which was the major contributor to the economy was lower by 3.7 per cent as compared to 2019 level (Chart 7). Accomodation sub-sector was the most affected which only managed to record less than half from the pre-pandemic level with 37.6 index point (Chart 8). On the other hand, Information & communication, Finance & insurance and Utilities have surpassed the economic level in 2019. On the demand side, Private final consumption expenditure recorded slightly lower than 2019 with 97.4 index point (Chart 9). Nonetheless, household components related to essential items namely Food & non-alcoholic beverages; Communication; and Housing, water, electricity, gas & other fuels have exceeded the 2019 consumption (Chart 10). Concurrently, expenditure on Gross fixed capital formation was also lower by 15.2 per cent in 2021 (Chart 9).

Based on the current scenario, the economic performance of the fourth quarter of 2021 signaled a recovery despite encountering the COVID-19 pandemic and natural disasters simultaneously. Towards the end of 2021, more economic, social and recreational activities resumed their operations as all states have transitioned to Phase 4 of the National Recovery Plan (NRP). The easing of inter-state travel restriction has given significant repercussions, especially on the domestic tourism-related industries. This positive development will enable entrepreneurs to restore business momentum, thus will drive economic rebound in Malaysia.

The Department of Statistics Malaysia is conducting the Household Income, Expenditure and Basic Amenities Survey (HIES/BA) 2022 from 1st January 2022 to 31st December 2022. The Department greatly appreciates the cooperation given by the selected respondents by sharing their information with DOSM officers and making the survey a success. Please visit www.dosm.gov.my for more information.

The full publication of Gross Domestic Product, Fourth Quarter 2021 can be downloaded through eStatistik portal.

| PERCENTAGE CHANGE FROM CORRESPONDING QUARTER OF PRECEDING YEAR | ||||||||

| 2020 | 2021 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | |

| GDP | -5.6 | 3.1 | -2.7 | -3.4 | -0.5 | 16.1 | -4.5 | 3.6 |

| PERCENTAGE CHANGE FROM PRECEDING QUARTER | ||||||||

| Seasonally Adjusted GDP | 17.3 | -1.5 | 2.7 | -1.9 | -3.6 |

6.6 |

||

Released By:

DATO' SRI DR. MOHD UZIR MAHIDIN

CHIEF STATISTICIAN MALAYSIA

DEPARTMENT OF STATISTICS, MALAYSIA

![]() DrUzir_Mahidin

DrUzir_Mahidin ![]()

![]() Dr_Uzir

Dr_Uzir

11 February 2022

Contact person:

Mohd Yusrizal Ab Razak

Public Relation Officer

Strategic Communication and International Division

Department of Statistics, Malaysia

Tel : +603-8885 7942

Fax : +603-8888 9248

Email : yusrizal.razak@dosm.gov.my

Subscribe

Newsletter

Subscribe to our newsletter and stay updated

For interviews, press statement and clarification to the media, contact:

Baharudin Mohamad

Public Relation Officer

Email: baharudin[at]dosm.gov.my

Phone: 03 8090 4681

Not found what you looking for? Request data from us, through

Go to eStatistik

Email: data[at]dosm.gov.my

Phone: 03 8885 7128 (data request)