Gross Domestic Product

- Home

- Statistics

- Economy

- National Accounts

- Gross Domestic Product

Malaysia Economic Performance First Quarter 2021

Malaysia Economic Performance Fourth Quarter 2020 13 November 2020

Malaysia Economic Performance Third Quarter 2020 14 August 2020

Malaysia Economic Performance Second Quarter 2020 13 May 2020

Malaysia Economic Performance First Quarter 2020 13 May 2020

Malaysia Economic Performance 2019 12 February 2020

Malaysia Economic Performance Fourth Quarter 2019 Show all release archives

Overview

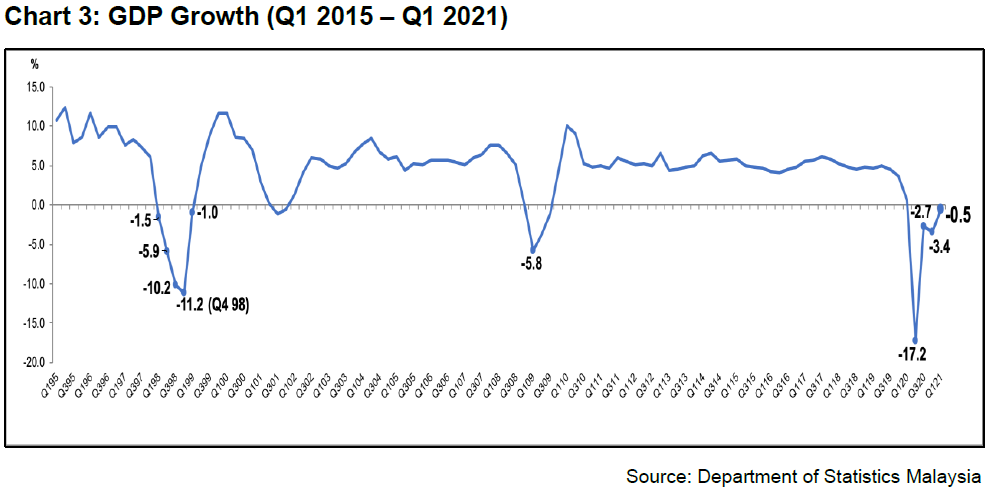

Malaysia’s GDP marginally decline 0.5 per cent in the first quarter of 2021, continues its recovery from a decrease of 3.4 per cent in the preceding quarter, as reported today in Gross Domestic Product First Quarter 2021. The economic performance was supported by the expansion in manufacturing sector and the rebound of agriculture sector. On the demand side, the uptick trend was attributed by the strong growth of exports of goods and services amid a smaller decline in household consumption and fixed asset investment.

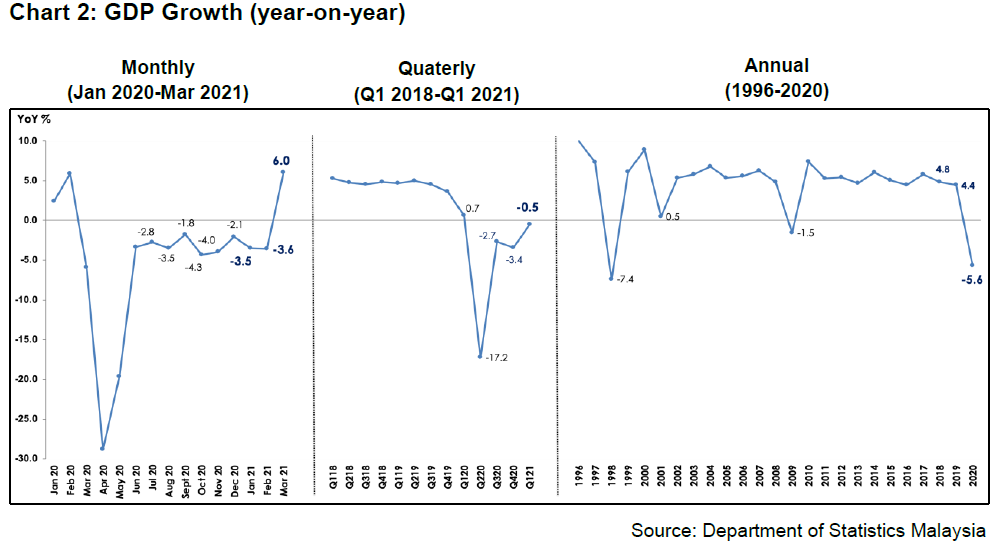

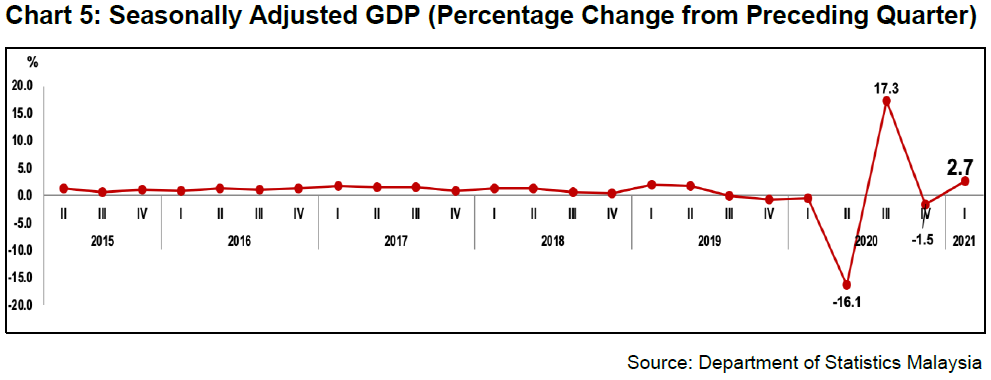

In terms of Malaysia's monthly GDP performance, January and February showed a decline of 3.5 per cent and 3.6 per cent respectively and rebounded strongly in March 2021 to 6.0 per cent. For the quarter-on-quarter seasonally adjusted, GDP rebounded to 2.7 per cent (Q4 2020: -1.5%) in this quarter. The gradual recovery of Malaysia’s economy was influenced by the reopening of more economic activities during the Movement Control Order (MCO) 2.0 which is less stringent than the MCO that was imposed last year and also benefitted from various stimulus packages to steer the economic recovery. The economy also spurred by disposable income due to withdrawal of i-Sinar, i-Lestari and the increase in commodity prices such as oil palm and rubber.

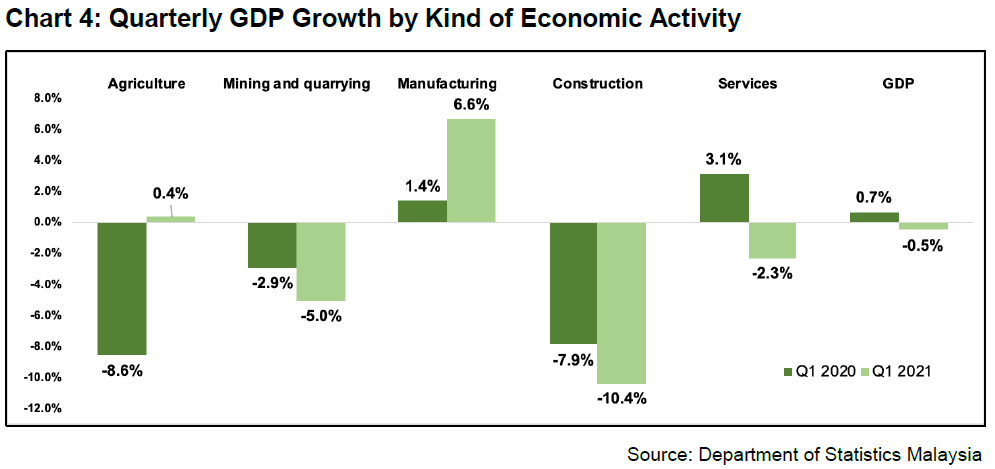

The Manufacturing sector grew stronger 6.6 per cent for the first quarter 2021 compared to 3.0 per cent in the fourth quarter of 2020 driven by the Electrical, electronics & optical products (10.6%) and Petroleum, chemical, rubber & plastics products (7.3%). The robust growth of Electrical, electronics & optical products was due to the higher demand of microchips in electronic devices. Furthermore, Transport equipment, other manufacturing & repair expanded further to 8.1 per cent as against 6.9 per cent in the preceding quarter. The continuous positive growth was contributed by the export-oriented industries which grew by 7.2 per cent (Q4 2020: 3.4%) in line with the overall exports performance which recorded double-digit growth of 18.2 per cent in the first quarter of 2021. Similarly, the performance of the domestic-oriented industries increased by 5.3 percent (Q4 2020: 2.4%) for the quarter.

Agriculture sector grew marginally to 0.4 per cent, a turnaround from a decrease of 1.0 per cent in the fourth quarter of 2020. The growth was supported by a better performance in Other agriculture at 5.7 per cent (Q4 2020: 3.6%) and Livestock which increased to 3.5 per cent (Q4 2020: 2.9%). Meanwhile, Forestry & logging rebounded to a double-digit growth of 11.5 per cent (Q4 2020: -9.2%).

Services sector which was a major contributor to the Malaysia’s GDP, decreased 2.3 per cent from a decline of 4.8 per cent in the previous quarter. The slower decrease was due to the rebound in the Wholesale and retail trade sub-sectors which recovered modestly at 1.2 per cent (Q4 2020: -1.4%) in the first quarter of 2021. Moreover, Finance and insurance; and Information and communication sub-sectors continued its expansion to 11.3 per cent and 6.3 per cent respectively. Nonetheless, Services sector remained in negative growth partly due to the Food & beverage and accommodation sub-sectors which fell 29.8 per cent (Q4 2020: -35.3%), improved slightly from the previous quarter. The improvement of Food & beverage and accommodation sub-sectors was due to the easing of MCO 2.0 whereby restaurants’ operating hours have been extended and dining-in was allowed as well as interstates travel was permitted for states under the RMCO to encourage domestic tourism activities. On the same note, Transportation and storage sub-sector decreased 16.2 per cent (Q4 2020: -23.0%), influenced by the decline in all segments except for Postal & courier which recorded a double-digit growth due to the increase in online shopping during MCO 2.0.

Mining and quarrying sector improved to a negative 5.0 per cent as compared to a 10.4 per cent decline in the fourth quarter of 2020. The performance of this sector was largely supported by the rebounded in Natural gas at 0.3 per cent (Q4 2020: -9.9%) and Crude oil & condensate at negative 11.5 per cent (Q4 2020: -12.9%).

Construction sector decreased by 10.4 per cent, an improvement from negative 13.9 per cent in the preceding quarter. This was attributed to a slower decreased in Residential buildings, Non-residential buildings and Civil engineering. On the contrary, Specialised construction activities expanded to 16.9 per cent (Q4 2020: 9.4%).

All components of expenditure shows a sign of recovery. This was mainly led by Exports and Imports which rebounded to a double-digit growth mainly supported by the expansion in goods. Meanwhile, exports of services continued to decline as national borders are still closed for travelling activities.

Private final consumption expenditure which contributed the most on the demand component, posted a smaller decrease of 1.5 per cent (Q4 2020: -3.5%) influenced by the expenditure on essential items namely Food & non-alcoholic beverages; Housing, water, electricity, gas and other fuels and Communication. In addition, Restaurants & hotels; Recreation services & cultural; and Furnishing, household equipment and routine household maintenance which were non-essential expenditure indicated a slower decline in this quarter. As the battle of COVID-19 continues, the consumption on Health increased at a marginal growth after registering a decline for three consecutive quarters.

Gross Fixed Capital Formation (GFCF) or investment on fixed assets registered a smaller contraction of 3.3 per cent in the first quarter of 2021. The recovery of GFCF indicated an improving trend which was backed by the double-digit growth in Machinery & equipment after recording a contraction for the past nine quarters. The gradual improvement of GFCF can be seen as a catalyst for higher economic capacity to uplift the production of the future output. Furthermore, the Government final consumption expenditure rose to 5.9 percent (Q4 2020: 2.4%) due to higher spending on supplies and services in this quarter.

In Malaysia, the spike of COVID-19 cases following the new wave of infections since the fourth quarter of 2020 has prompted the reinstatement of CMCO in various states. Subsequently, the worsening of the pandemic has led to reimposition of MCO 2.0 in six states since 13th January 2021 and was expanded to almost all states. Nevertheless, MCO 2.0 allows more economic sectors to operate with strict Standard Operating Procedures (SOPs) and this may lessen when immunisation started in February 2021 by targeting over 26 million Malaysian residents. The National COVID-19 Immunisation Programme (PICK) is expected to restore business confidence and improve the country's economic growth. Likewise, short-term economic indicators namely Leading Index (LI) for February 2021 signals Malaysia is heading towards an economic expansion in the upcoming months.

The full publication of Gross Domestic Product, First Quarter 2021 can be downloaded through eStatistik portal.

| PERCENTAGE CHANGE FROM CORRESPONDING QUARTER OF PRECEDING YEAR | ||||||||

| 2019 | 2020 | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | ||

| GDP | 4.4 | -5.6 | 0.7 | -17.2 | -2.7 | -3.4 | -0.5 | |

| PERCENTAGE CHANGE FROM PRECEDING QUARTER | ||||||||

| Seasonally Adjusted GDP | -0.5 | -16.1 | 17.3 | -1.5 | 2.7 | |||

Released By:

DATO' SRI DR. MOHD UZIR MAHIDIN

CHIEF STATISTICIAN MALAYSIA

DEPARTMENT OF STATISTICS, MALAYSIA

![]() DrUzir_Mahidin

DrUzir_Mahidin ![]()

![]() Dr_Uzir

Dr_Uzir

11 May 2021

Contact person:

Mohd Yusrizal Ab Razak

Public Relation Officer

Strategic Communication and International Division

Department of Statistics, Malaysia

Tel : +603-8885 7942

Fax : +603-8888 9248

Email : yusrizal.razak@dosm.gov.my

Subscribe

Newsletter

Subscribe to our newsletter and stay updated

For interviews, press statement and clarification to the media, contact:

Baharudin Mohamad

Public Relation Officer

Email: baharudin[at]dosm.gov.my

Phone: 03 8090 4681

Not found what you looking for? Request data from us, through

Go to eStatistik

Email: data[at]dosm.gov.my

Phone: 03 8885 7128 (data request)