Overview

PERFORMANCE OF GFCF

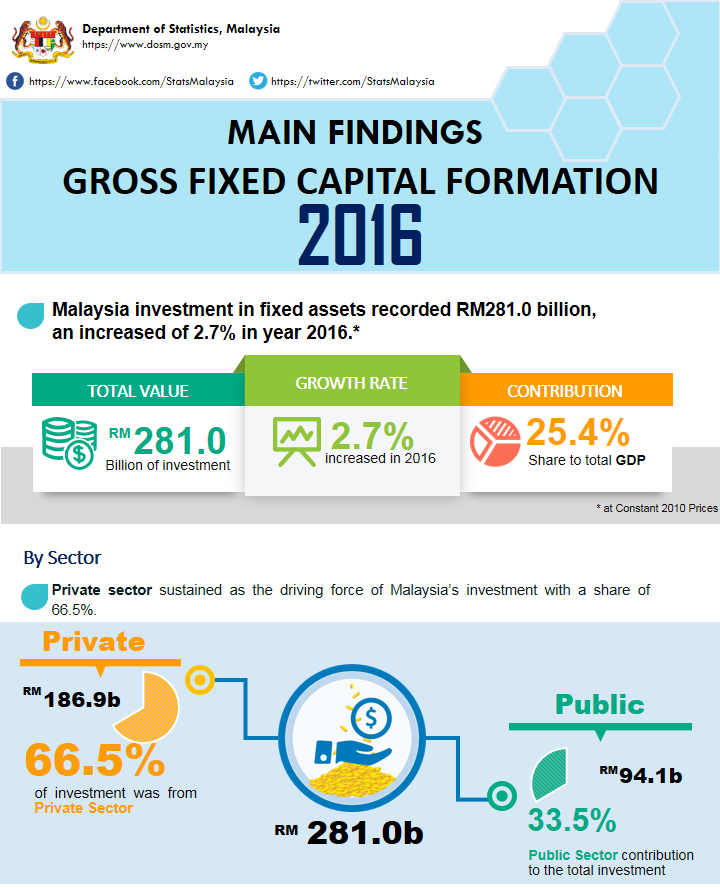

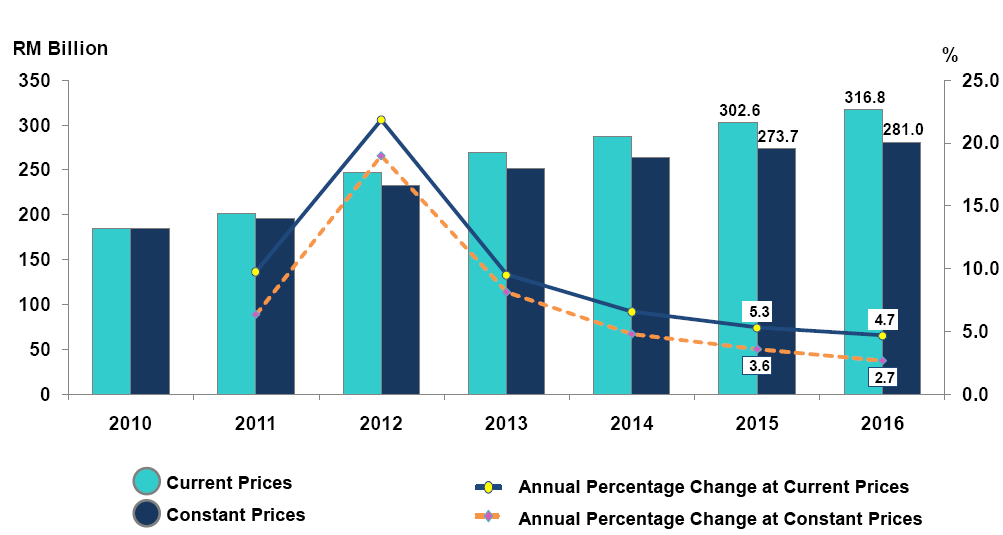

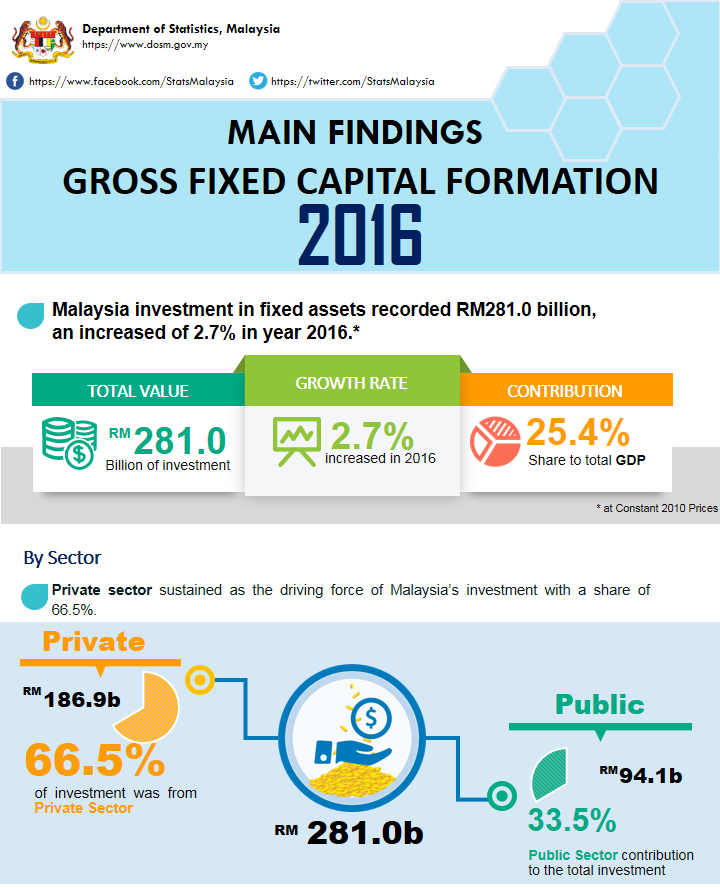

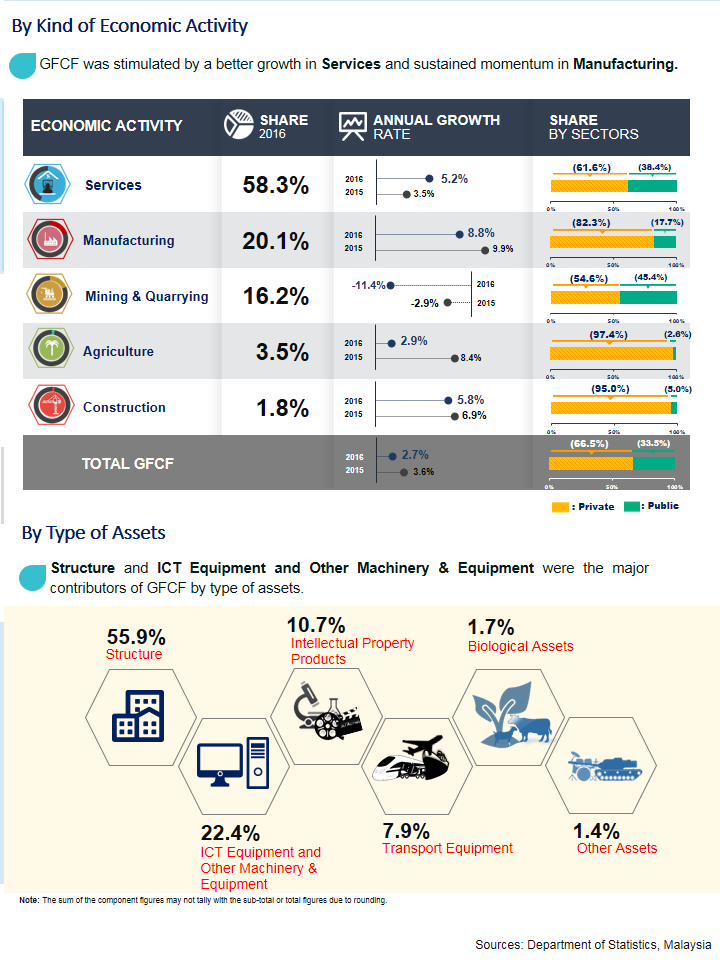

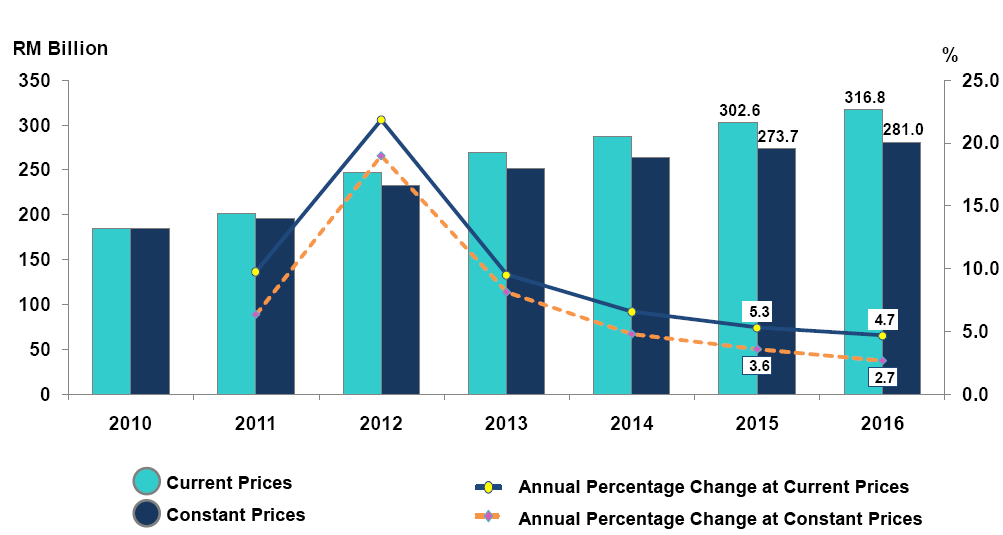

Gross Fixed Capital Formation (GFCF) rose to 2.7 per cent (Chart 1) stimulated by a better growth in Services and sustained momentum in Manufacturing. Nevertheless, the contraction in Mining & Quarrying has influenced the investment performance in 2016. The fixed asset investment was continuously led by the Private sector. Meanwhile, Structure was the main driver for type of assets.

In nominal terms, GFCF elevated further to RM316.8 billion as compared to RM302.6 billion in the preceding year.

Chart 1: GFCF for year 2010-2016 at Current Prices and Constant 2010 Prices

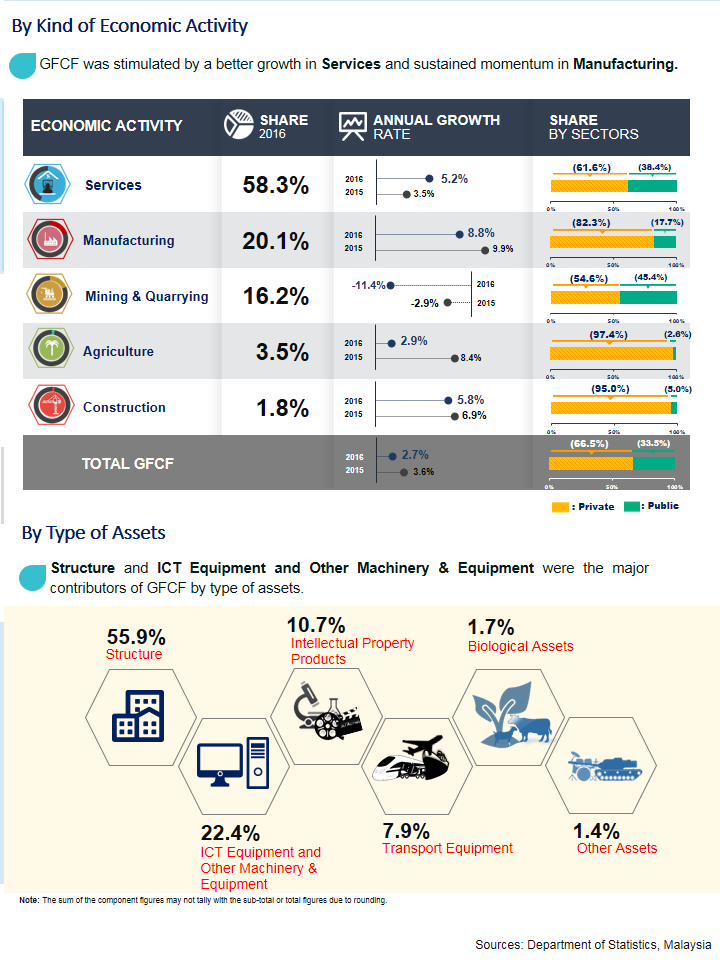

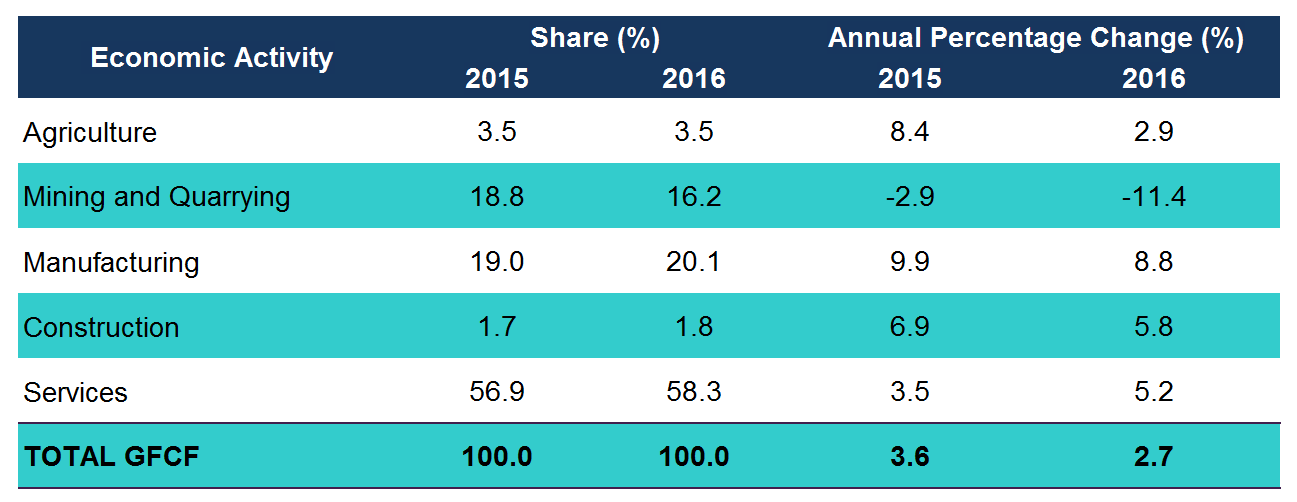

GFCF BY KIND OF ECONOMIC ACTIVITY

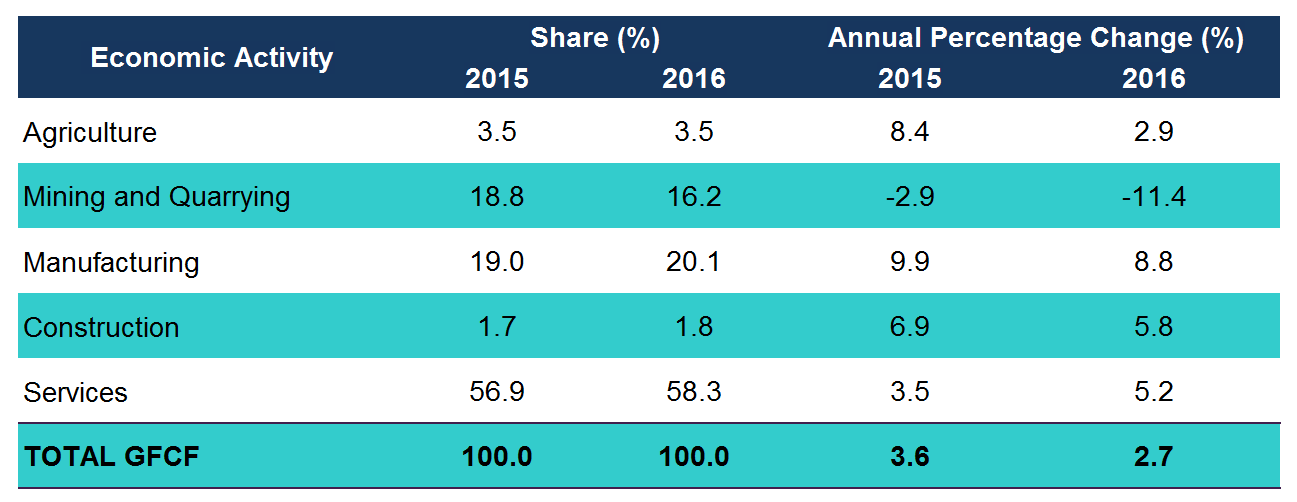

In 2016, GFCF for all activities posted a positive growth with the exception of Mining & Quarrying (Table 1) due to lower crude oil prices.

Table 1: GFCF for year 2015 and 2016 at Constant 2010 Prices

Services posted a growth of 5.2 per cent (2015: 3.5%) driven mainly by the Finance, Insurance, Real Estate & Business Services which grew 13.5 per cent (2015: 13.7%). Furthermore, a rebound in Transportation & Storage and Information & Communication to 2.9 per cent (2015: -5.8%) supported the overall growth. Nevertheless, Other Services (including Government Services) showed a reverse trend to negative 1.4 per cent as compared to 0.4 per cent in the previous year.

Investment in Manufacturing expanded 8.8 per cent (2015: 9.9%) as Petroleum, Chemical, Rubber and Plastic Products posted a robust growth of 25.2 per cent (2015: 18.1%). The growth was further reinforced by 2.8 per cent increase in Electrical, Electronic & Optical Products and Transport Equipment (2015: 5.3%). On the other hand, Food, Beverages & Tobacco decreased 8.5 per cent after registering positive growth of 8.2 per cent in 2015.

Agriculture eased to 2.9 per cent (2015: 8.4%) due to a sluggish performance in Rubber and Oil Palm with a growth of 1.2 per cent (2015: 10.2%). On the positive note, Livestock and Fishing improved to 8.8 per cent. Construction grew 5.8 per cent in 2016 as compared to 6.9 per cent in previous year.

The major drop in crude oil prices since 2015 has significantly reduced the new acquisition of fixed asset in Mining & Quarrying which posted a negative growth of 11.4 per cent (2015: -2.9%).

GFCF BY TYPE OF ASSETS

Structure dominated with a share of 55.9 per cent which grew 4.9 per cent in 2016. However, the contribution of ICT Equipment and Other Machinery & Equipment has marginally reduced to 22.4 per cent (share 2015: 22.8%) due to the lethargic performance of these types of asset which grew 0.8 per cent as compared to 4.1 per cent in the previous year.

GFCF BY SECTOR

Private sector (share: 66.5%) remained as the catalyst of Malaysia’s investment with a growth of 4.3 per cent in 2016. Meanwhile, the investment in Public sector marginally declined to 0.5 per cent from a negative growth of 1.1 per cent in the preceding year.

GFCF BY SECTOR AND KIND OF ECONOMIC ACTIVITY

Services and Manufacturing activities were the main impetus in GFCF of Private sector. The share of Services stepped-up to 54.0 per cent (2015: 51.8%) while Manufacturing maintained its position as the second contributor with a share of 24.9 per cent (2015: 24.7%) . The remaining activities made-up 21.1 per cent of the total Private GFCF.

GFCF of Public sector was largely dominated by Services and Mining & Quarrying activities with a share of 66.8 per cent and 22.0 per cent respectively. Meanwhile, the share of Manufacturing improved further to 10.6 per cent (2015: 8.3%) attributed by petroleum and chemical downstream activities.

Released By:

THE OFFICE OF CHIEF STATISTICIAN MALAYSIA

DEPARTMENT OF STATISTICS, MALAYSIA

26 July 2017

Contact person:

Ho Mei Kei

Public Relation Officer

Corporate and User Services Division

Department of Statistics, Malaysia

Tel : +603-8885 7942

Fax : +603-8888 9248

Email : mkho[at]stats.gov.my