Gross Domestic Product

- Home

- Statistics

- Economy

- National Accounts

- Gross Domestic Product

Malaysia Economic Performance First Quarter 2018

Gross Domestic Product Fourth Quarter 2017 17 November 2017

Gross Domestic Product Third Quarter 2017 18 August 2017

Gross Domestic Product Second Quarter 2017 19 May 2017

Gross Domestic Product First Quarter 2017 19 May 2017

Gross Domestic Product 2016 16 February 2017

Gross Domestic Product Fourth Quarter 2016 Show all release archives

Overview

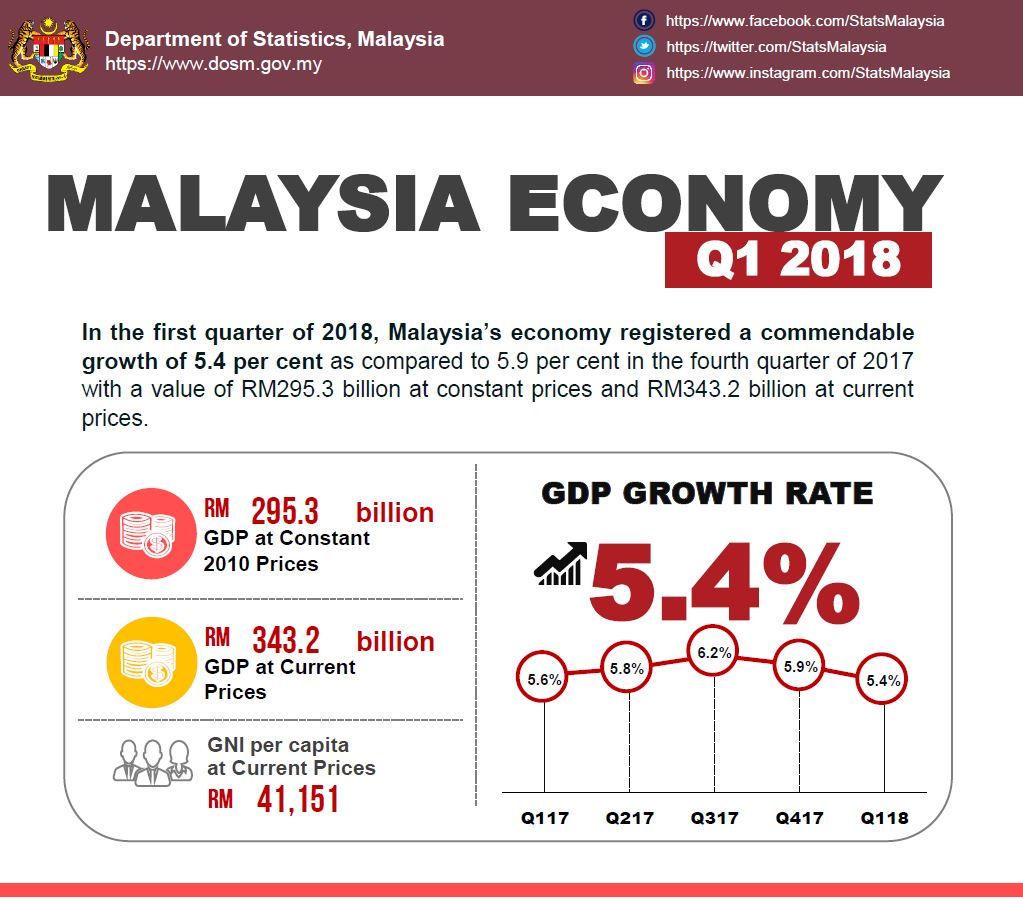

In the first quarter of 2018, Malaysia’s economy continued its momentum by registering a growth of 5.4 per cent (Q4 2017: 5.9%). On a seasonally adjusted quarter- on-quarter, the GDP for first quarter of 2018 grew 1.4 per cent.

All sectors posted a positive growth with a turnaround in Mining and quarrying sector. Services and Manufacturing sectors remained as the anchor to the expansion in the first quarter of 2018. On the expenditure side, Private Final Consumption Expenditure and net exports were the key drivers.

During the period, Malaysia’s GDP recorded a value of RM295.3 billion at constant prices and RM343.2 billion at current prices.

| PERCENTAGE CHANGE FROM CORRESPONDING QUARTER OF PRECEDING YEAR | |||||||

| 2016 | 2017 | Q1 2017 | Q2 2017 | Q3 2017 | Q4 2017 | Q1 2018 | |

| GDP | 4.2 | 5.9 | 5.6 | 5.8 | 6.2 | 5.9 | 5.4 |

| PERCENTAGE CHANGE FROM PRECEDING QUARTER | |||||||

| Seasonally Adjusted GDP | 1.7 | 1.3 | 1.7 | 1.0 | 1.4 | ||

GDP by Production Approach

Services sector stepped up to 6.5 per cent from 6.2 per cent in the preceding quarter. Wholesale & retail trade, Finance & insurance and Information & communication sub-sectors were the impetus to the growth of Services sector in this quarter. Wholesale, retail trade and motor vehicle grew 6.8 per cent supported by wholesale and retail segment. However, motor vehicles contracted 0.5 per cent in this quarter. Meanwhile, Finance & insurance sub-sector rose to 7.5 per cent, the strongest growth since Q4 2012 contributed by both Finance and Insurance which expanded to 6.7 per cent (Q4 2017: 5.0%) and 9.8 per cent (Q4 2017: 7.8%) respectively. Information & communication increased to 8.3 per cent from 8.1 per cent in the previous quarter.

Manufacturing sector continued a positive momentum albeit at a moderate pace of 5.3 per cent as compared to 5.4 per cent in the preceding quarter. The growth for Manufacturing sector was led by a steady momentum in Electrical, electronic & optical products at 6.0 per cent as compared to the fourth quarter growth of 5.7 per cent. Moreover, Petroleum, chemical, rubber & plastic products rose to 5.0 per cent (Q4 2017: 4.5%) supported by refined petroleum products and chemical products.

Construction sector grew 4.9 per cent (Q4 2017: 5.9%), while quarter-on-quarter seasonally adjusted registered an increase of 1.5 per cent from 0.5 per cent. Civil engineering posted an impressive growth of 15.4 per cent, the highest growth since fourth quarter of 2016. The strong momentum was mainly geared by transportation and utilities related projects. Specialised construction activities recorded growth of 7.3 per cent from 8.6 per cent in the preceding quarter.

GDP by Expenditure Approach

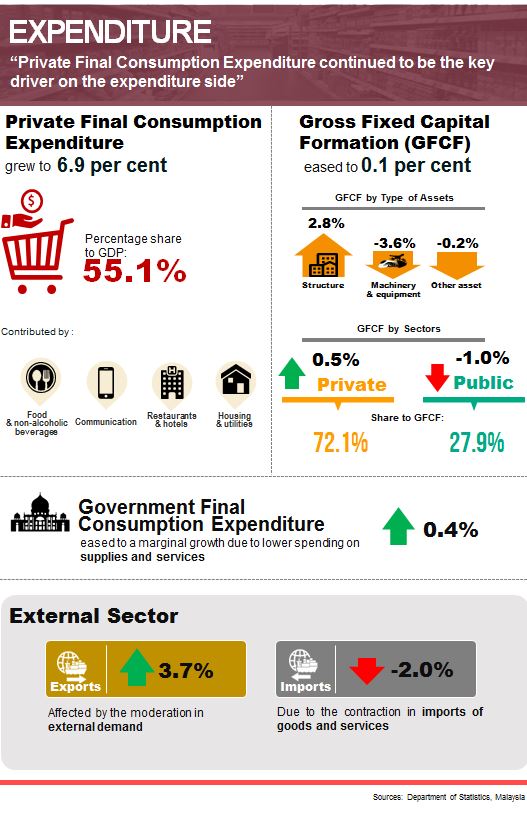

Private Final Consumption Expenditure grew 6.9 per cent (Q4 2017: 7.0%), while on a quarter-on-quarter seasonally adjusted increased to 2.0 per cent. The growth was contributed by the consumption on food & non-alcoholic beverages, communication, restaurants & hotels and housing & utilities.

Gross Fixed Capital Formation (GFCF) eased to 0.1 per cent from 4.3 per cent in the previous quarter. The slower momentum in GFCF was due to the deceleration in Machinery & equipment (-3.6%) as well as Other asset (-0.2%). Nevertheless, Structure increased 2.8 per cent as compared to 3.3 per cent in the last quarter, in parallel with the growth of Construction sector.

Exports recorded a growth of 3.7 per cent while Imports registered a negative growth of 2.0 per cent due to the contraction in imports of goods and services.

Prices

During the quarter CPI eased to 1.8 per cent (Q4 2017: 3.6%) due to lower prices in Food & non-alcoholic and Transport groups. The average price of RON 95 in this quarter was RM2.20 per litre as compared to RM2.23 per litre in first quarter of 2017.

Producer Price Index decreased to 2.3 per cent as compared 3.1 per cent in fourth quarter of 2017. The decrease was mainly due to the lower prices of goods in Agriculture, forestry & fishing (-13.1%). Average prices of Crude Palm Oil recorded RM2,462 per tonne as compared to RM2,628 per tonne registered in the previous quarter.

External Sector

The current account balance recorded a value of RM15.0 billion as compared to RM13.9 billion in the fourth quarter of 2017. The highest surplus in current account was contributed by goods account with a surplus of RM35.7 billion while the deficit in the services account narrowed to RM5.8 billion (Q4 2017: deficit RM7.0 billion). This high surplus was last recorded in second quarter of 2014.

Exports

The better performance of current account balance was attributed to the goods account. In this quarter, exports of goods was valued at RM237.6 billion, a growth of 5.8% on a year-on-year (y-o-y) basis. The main products which contributed to the increase were electrical and electronic (E&E) products which has the highest share in total exports at 37.1%, rising 1.8% to RM88.1 billion followed by crude petroleum ( 3.6% share of total exports) which expanded by 8.0% to RM8.5 billion.

Other major export products namely palm-oil & palm-oil based products, refined petroleum products and LNG declined 6.7%, 6.4% and 0.4% respectively.

Imports

In the first quarter of 2018, imports decreased 0.8% to RM204.3 billion on a y-o-y basis, compared to 14.4% growth in the preceding quarter. Consumption goods recorded an increase while intermediate and capital goods decreased.

Consumption Goods which accounted for 8.2% of total imports recorded an increase of RM383 million (+2.3%) to RM516.8 billion. The main component contributing to the rise was food & beverages, mainly for household consumption (+RM320 million, +2.3%).

Intermediate Goods which constituted 53.5% of total imports dropped RM12.5 billion (-10.5%) to RM32.8 billion. The decrease was mainly attributed to parts & accessories of capital goods (except transport equipment) (-RM9.9 billion,-22.7%), fuel & lubricants, primary (-RM2.0 billion, -22.5%) and food & beverages, processed, mainly for industries (-RM1.4 billion, -35.1%).

Capital Goods, representing 13.0% of total imports fell RM4.0 billion or 13.0% to RM26.5 billion due to the decrease of RM4.6 billion or 17.1% in capital goods (except transport equipment).

Labour Market Condition

Overall, employment increased 2.3 per cent (Q4 2017: 2.2%) to register 14.7 million persons (Q4 2017: 14.6 million persons) contributed by own account workers. Meanwhile, employees who receive regular remuneration recorded a slower growth attributed by the performance of businesses in this quarter.

In total economy, Compensation of Employees contributed 35.3 per cent while Gross Operating Surplus constituted 59.5 per cent. The remaning 5.2 per cent was net indirect taxes.

Based on the Monthly Manufacturing Survey, employment grew 2.1 per cent (Q4 2017: 2.4%) in line with the performance of this sector which posted 5.3 per cent (Q4 2017: 5.4%). However, salaries & wages increased 13.9 per cent after registering 9.4 per cent in previous quarter.

Simultaneously, employment in Services sector grew 1.7 per cent (Q4 2017: 2.2%) while salaries & wages posted a growth of 3.5 per cent (Q4 2017: 5.0%)

During this quarter, the unemployment rate dropped slightly to 3.3 per cent from 3.4 per cent in previous quarter

RELEASED BY:

DATO' SRI DR. MOHD UZIR MAHIDIN

CHIEF STATISTICIAN MALAYSIA

DEPARTMENT OF STATISTICS, MALAYSIA

17 May 2018

Contact person:

Ho Mei Kei

Public Relation Officer

Corporate and User Services Division

Department of Statistics, Malaysia

Tel : +603-8885 7942

Fax : +603-8888 9248

Email : mkho[at]dosm.gov.my

Subscribe

Newsletter

Subscribe to our newsletter and stay updated

For interviews, press statement and clarification to the media, contact:

Baharudin Mohamad

Public Relation Officer

Email: baharudin[at]dosm.gov.my

Phone: 03 8090 4681

Not found what you looking for? Request data from us, through

Go to eStatistik

Email: data[at]dosm.gov.my

Phone: 03 8885 7128 (data request)